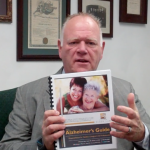

Married couples facing an Alzheimer’s diagnosis should consider planning with a competent Elder Law Attorney as early on as possible for a few reasons. One reason being, people often make the assumption that if you’re married, that automatically gives you the legal right to take care of everything for each other. That’s not the case, […]

Married Couples and Medicaid: Establishing Eligibility is Much Easier and Can Happen Much Sooner than You Probably Think

With the help of a good Elder Law attorney, establishing eligibility for Medicaid for a spouse in a nursing home can occur much sooner and is much easier to accomplish than what you might expect. Within the Medicaid eligibility rules, there are plenty of opportunities for achieving this. Because of the way the income rules work […]

Is Protecting Assets From Long-Term Care Costs Ethical and Moral?

The planning involved in protecting someone’s assets from the devastating costs of long-term care often spark questions with regards to its ethical and moral standpoints. As to a moral standpoint, Alzheimer’s is a destructive disease that requires a specific kind of care, usually involving a long-term care facility. While there is financial help for people […]

Married Couples and Medicaid: Understanding the Division of Assets Process

How the division of assets is handled, in regards to Medicaid eligibility, is important for many married couples facing one spouse entering a nursing home. This is one instance in which Missouri law and Illinois law is very different and that is the question of how much in assets the community spouse, the one not in […]

Does Gift Tax Affect Me?

One of the cornerstones of asset preservation planning is getting assets out of your name and out of harms way, which often leads to the question, “Will I have to pay gift tax?” This is a valid question. As part of the planning, assets may be moved into a trust, which is a great way […]

- « Previous Page

- 1

- …

- 9

- 10

- 11

- 12

- 13

- …

- 30

- Next Page »